- #POM QM MARGINAL MARKOV ANALYSIS HOW TO#

- #POM QM MARGINAL MARKOV ANALYSIS SOFTWARE#

- #POM QM MARGINAL MARKOV ANALYSIS WINDOWS#

Please show how to solve the problems step-by-step.

Note: The "a = 0.20 - the "a" here is a symbol that I can't find on the computer to make it correctly. Compare this forecast with the three-month moving average computed in Problem #1 (a) using mead absolute deviation (MAD) and indicate which forecast seems to be most accurate. Which one should the dealer use for January of the next year?ĭevelop an exponential smoothing forecast with a = 0.20 for the demand in Problem #1. Compare the two forecasts computed in parts (a) and (b) using mead absolute deviation (MAD). Compute a five-month moving average forecast for June through January.Ĭ. Compute a three-month moving average forecast of demand for April through January (of the next year).ī.

#POM QM MARGINAL MARKOV ANALYSIS WINDOWS#

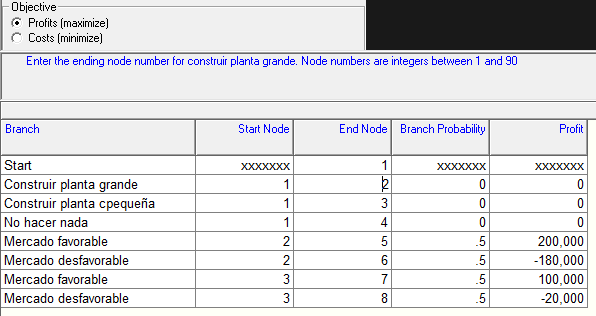

From sales records, the dealer has accumulated the data in the table below for the past year:Ī. QM for Windows has a Markov analysis module, which is extremely useful when the dimensions of the transition matrix exceed two states. Paul area wants to be able to forecast accurately the demand for the Roadhog Super motorcycle during the next month. The Harley Davis motorcycle dealer in the Minneapolis-St. The problems are taken from the textbook: Operations Management: Quality and Competitiveness in a Global Environment (5th edition) by Roberta S. Use POM-QM for Windows to solve the following problems. This content was COPIED from - View the original, and get the already-completed solution here!

#POM QM MARGINAL MARKOV ANALYSIS SOFTWARE#

Using Software for Forecasting Time Series.5.4 Forecasting Models-Random Variations OnlyForecasting Models-Random Variations Only.Appendix 4.1: Formulas for Regression Calculations.4.11 Cautions and Pitfalls in Regression Analysis.Evaluating the Multiple Regression Model.4.6 Using Computer Software for Regression.4.4 Assumptions of the Regression Model.4.3 Measuring the Fit of the Regression Model.

Measuring Utility and Constructing a Utility Curve.Potential Problem in Using Survey Results.3.7 How Probability Values Are Estimated by Bayesian Analysis.3.5 Using Software for Payoff Table Problems.Criterion of Realism (Hurwicz Criterion).3.2 Types of Decision-Making Environments.Appendix 2.1: Derivation of Bayes’ TheoremDerivation of Bayes’ Theorem.Solving Problems with the Binomial Formula.Probability Distribution of a Continuous Random Variable.Variance of a Discrete Probability Distribution.Expected Value of a Discrete Probability Distribution.Probability Distribution of a Discrete Random Variable.2.2 Revising Probabilities with Bayes’ TheoremRevising Probabilities with Bayes’ Theorem.Probability Rules for Unions, Intersections, and Conditional Probabilities.Mutually Exclusive and Collectively Exhaustive Events.Chapter 2 Probability Concepts and Applications.Lack of Commitment by Quantitative Analysts.Lack of Commitment and Resistance to Change.1.7 Implementation-Not Just the Final StepImplementation-Not Just the Final Step.1.6 Possible Problems in the Quantitative Analysis Approach.1.5 The Role of Computers and Spreadsheet Models in the Quantitative Analysis Approach.Mathematical Models Categorized by Risk.The Advantages of Mathematical Modeling.1.4 How to Develop a Quantitative Analysis Model.The Quantitative Analysis Approach and Modeling in the Real World.Analyzing the Results and Sensitivity Analysis.Chapter 1 Introduction to Quantitative Analysis.Significant Changes to the Thirteenth Edition.Stair, Barry Render Quantitative Analysis for Management, 13/e Appendix 14.1: Markov Analysis with QM for Windows by Trevor S.

0 kommentar(er)

0 kommentar(er)